Consumers trust AI recommendations more than paid advertisements. In fact, 41% of buyers now value generative answers over ads when making purchase decisions.

When an AI suggests your competitor instead of you, it acts as a third-party endorsement. You might outrank your competitor on Google, but if the AI tells potential clients that they’re the industry leader, you lose the deal.

That’s why mastering AI search competitor analysis is the first step. This guide covers how to analyze competitors in generative AI search, reverse-engineer their citation sources, and reclaim market share.

What Is AI Competitor Analysis?

AI competitor analysis means looking at how Large Language Models (LLMs) perceive, describe, and recommend your competitors. Instead of focusing on keyword rankings or backlinks, you study the stories and sources these models rely on when giving their answers.

It answers four questions that traditional tools cannot:

- Share of voice: How often is your competitor recommended in the answer (not just the search result)?

- Brand sentiment: How does the AI define them? Does it associate them with specific attributes like “security,” “speed,” or “innovation”?

- Citation provenance: Which specific third-party sources is the AI citing to back up its claims?

- Platform variance: Are they dominating ChatGPT (brand awareness) while losing on Perplexity (citation traffic)?

How to Analyze Competitors in Generative AI Search Automatically (Using GEO Platforms)

To understand your competitor’s actual strategy, you need to look at the data over time across thousands of queries. This process can be automated using a dedicated GEO platform that tracks AI visibility, citations, and model-level performance over time.

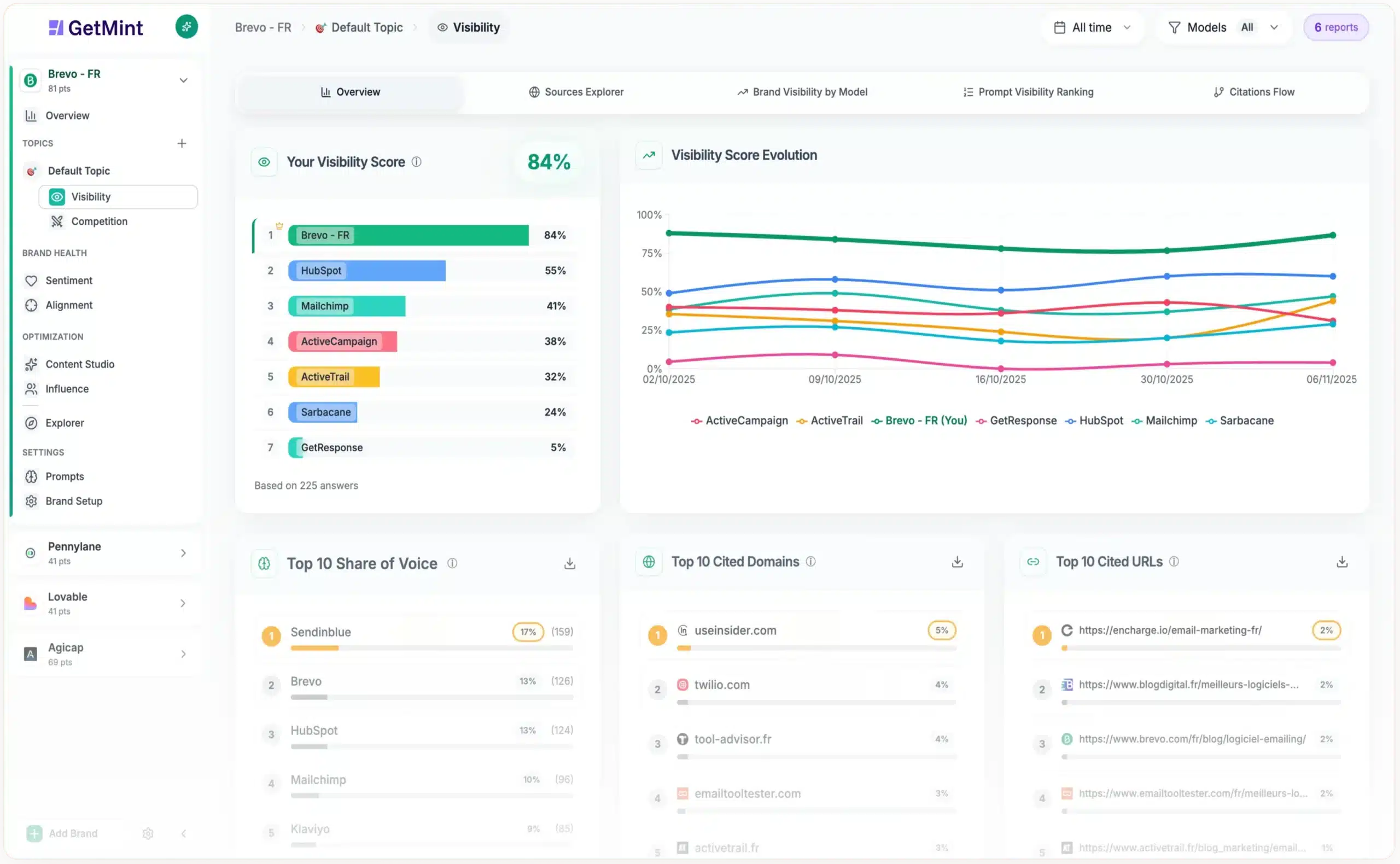

Below, we’ll use GetMint as an example to illustrate what this data looks like in practice.

Step 1: Measure Visibility and Share of Voice

Before you analyze what is being said, you need to measure the magnitude of your competitor’s presence.

You need to look at two specific metrics side-by-side to understand their dominance:

- AI Visibility Score: This measures probability. It answers the question, “When a user asks about a category, how likely is this competitor to appear?” If your competitor has a 90% visibility score, they’re the default answer. They’re being mentioned in 9 out of every 10 relevant conversations.

- AI Share of Voice: This measures market share. It answers the question, “Of all the brands mentioned in this space, how much of the conversation do they own?”

Comparing these two numbers tells you exactly what kind of competitor you’re dealing with.

→ A high visibility and a high share of voice mean they’re a monopoly. They’re the only brand the AI cares about. Your strategy must be displacement; you have to give the AI a reason to stop citing them.

→ A high visibility but a low share of voice means the market is fragmented. The AI lists many options (including your competitor), but no single brand dominates. Your strategy is differentiation. You need to stand out from the crowd.

→ A low visibility but a high share of voice means that you’re dealing with a niche monopoly. It means the AI rarely mentions any brands for these prompts (perhaps it prefers generic advice), but when it does, it almost always picks the competitor. Create authoritative content that forces the AI to start citing your solution to capture the space.

→ A low visibility and a low share of voice mean that the competitor is irrelevant. They rarely appear, and when they do, they’re a last-resort solution. Ignore them; they’re not influencing the AI’s narrative. Focus your energy on the competitors in the “high visibility” quadrants.

Step 2: Analyze Mentions and Citations

Most people skip this step. You need to know if the AI is recommending your competitor because they have a famous brand or because they have authoritative content.

To figure this out, look at the ratio between their AI mentions and AI citations.

High Mentions/High Citations

If a competitor is dominating both, they’re the category king. The AI knows their brand (reputation) and uses their content as the source of truth (data).

→ Don’t attack them head-on. You can’t win a volume war against a category king. Instead, use differentiation. Focus your GEO strategy on winning specific feature comparisons or use-case prompts (e.g., “Best alternative to [Competitor] for small teams”), where their broad dominance makes them vulnerable to a specialist solution.

High Mentions/Low Citations

If your competitor has high mentions but low citations, it means they win on reputation. The AI knows their name and recommends them frequently, but it isn’t linking to their specific articles as proof. They likely have strong PR, a long history in the market, or massive social buzz. Examples include Coca-Cola, Tesla, and Nike.

→ You can’t beat them with blog posts alone. You need a brand awareness campaign to get your name into the training data of the model.

Low Mentions/High Citations

If your competitor is being cited more than mentioned, it means they win on data. The AI uses their whitepapers, documentation, or blog posts as sources of truth, but it doesn’t necessarily recommend the brand itself as a solution.

Usually, these competitors are institutional authorities like MIT, the World Bank, or government agencies. These entities dominate citations because they provide the raw data the AI relies on. Realistically, you’re not going to displace them as a primary source of truth.

However, if a direct business rival fits this profile, it means they have excellent technical content and Schema markup but weak authority.

→ For commercial rivals, you can beat them by creating better, more structured content. If you provide a more concise, data-rich answer that’s easier for the AI to parse, the model will often swap their citation for yours.

Pro Tip: If your competitor has high citations, click through to see which pages are being cited. Usually, it’s not their homepage. It’s a specific “ultimate guide” or a technical documentation page. That’s what you need to outrank.

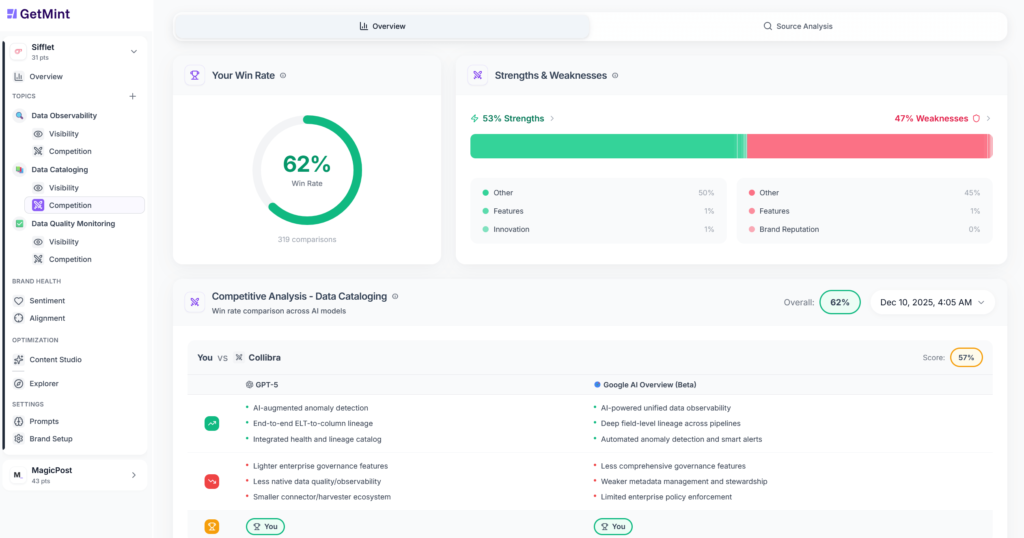

Step 3: Decode Their Narrative

Knowing your competitor is visible is useless if you don’t know why the AI prefers them. You need to extract the consensus view of the market. What does the AI actually think of their product?

Advanced tools such as GetMint run an automated SWOT analysis on thousands of mentions to surface patterns in the AI’s description of your rival.

Common Strengths

These are the specific selling points the AI consistently repeats. For example, it might praise your competitor for “seamless integration with Salesforce” or “best-in-class security.”

This is their defensive moat. The AI has learned to associate these specific values with their entity. When writing content, you have to highlight these capabilities (if your solution offers them) and how they compare to your competitor’s.

Common Weaknesses

There are the recurring complaints or limitations the AI consistently repeats. For example, they might say your competitor has “a steep learning curve” or “hidden fees.”

This is your attack vector. If the AI consistently flags your competitor as “complex,” you have a clear mandate to position your brand as “the intuitive alternative.”

Pro Tip: Don’t just read these insights; use them. Take your competitor’s top-cited weakness and address it directly in your homepage headline. If the AI thinks they’re “expensive,” update your pricing page to explicitly compare your value against theirs. This trains the model to see you as the solution to their flaw.

Step 4: Detect Platform Bias

AI isn’t a monolith. Your competitor might be winning on ChatGPT but effectively invisible on Google or Perplexity. To find their weak spot, you need to look at the model breakdown.

This view compares your performance against your rival across every specific engine your GEO tool tracks. This reveals the specific type of data fueling their success.

- If your competitor is winning on Perplexity, this means they likely have strong, recent news coverage or a high volume of citations (since Perplexity prioritizes real-time web access).

- If they’re winning on Claude, this means they likely have strong long-form technical content or documentation (since Claude processes large context windows well).

- Winning on ChatGPT suggests they have high general brand awareness and historical presence in the training data.

Don’t try to fight your competitor everywhere at once. If they have a lock on ChatGPT (brand awareness) but are losing on Perplexity (citations), focus your effort on the citation battle first. It’s easier to win a new source than to overwrite a model’s long-term training memory.

Pro Tip: If you see a competitor winning on Google AI Overviews but losing elsewhere, it means their traditional SEO is strong but their brand is weak. They’re ranking because of keywords, not entity authority. This is the best opportunity to outflank them with a GEO strategy that builds brand trust.

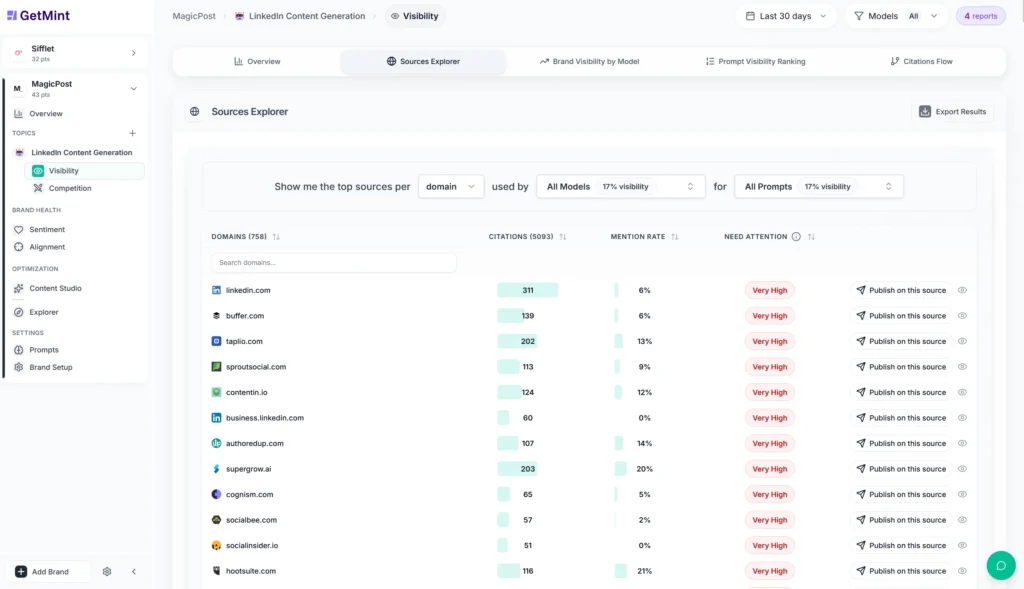

Step 5: Conduct a Source Analysis

Although it seems that AI models have “opinions,” their answers are actually synthesized from a vast library of sources. If an AI recommends your competitor, it’s pulling that authority from specific third-party URLs. To dismantle their lead, you need to identify the AI citations driving their success.

GetMint’s Source Analysis, for example, identifies the exact list of domains (and specific URLs) that the AIs use when asked about your topic.

You might find that 20% of your competitor’s citations come from a single “Best Tools of 2025” listicle on a high-authority industry blog. This list becomes your digital PR roadmap.

- If your competitor wins on review sites (G2/Capterra), you need to launch a campaign to generate fresher reviews, as the AI is prioritizing user sentiment.

- If they win on news sites (TechCrunch/Forbes), they have a PR advantage. You need to pitch those specific outlets to get coverage that balances the narrative.

- If they win on niche blogs, then you shouldn’t be too worried. Niche blogs are easier to win. Reach out to the authors of those specific articles and ask to be included (or corrected) in their content.

Pro Tip: Look for “zombie sources.” Usually, a competitor is winning because the AI is citing a 3-year-old comparison article that’s factually outdated. If you find one of these, don’t ignore it. Reach out to the publisher with updated data. If you get the article updated, the AI will likely ingest the new info and shift its recommendation.

How to Analyze Competitors in AI Search Manually

Auditing your competitors using standard AI interfaces is a good place to start if you don’t want to invest in a GEO platform yet. This process gives you an idea of where you currently stand.

Step 1: Ask the AI for a Direct Comparison

Start by asking your AI model of choice to compare you directly to your competitor. Use these prompts:

- “Compare [My Brand] vs. [Competitor]”

- “Between [My Brand] and [Competitor], which is better for [Use Case]?”

- “What are the pros and cons of [Competitor]?”

Look for a gap in the narrative. Does the AI hallucinate features for them? Does it label them as the “premium” option and you as the “budget” option? Does the way it describes your brand align with its values?

Step 2: Audit the Citation Sources

Next, you need to find out why your competitor is winning. This is as simple as checking the footnotes in the AI’s answers. Perplexity includes source cards and a “sources” footnote, whereas ChatGPT references them directly in the text with a citation blurb at the end.

Make a list of these domains. If your competitor is being cited by specific industry blogs or review sites, those are the sources you need to target with your own AI search optimization strategy.

Step 3: Run an Unbranded Discovery Test

Finally, check who the AI recommends when your brand name isn’t mentioned. Ask discovery questions like.

- “What are the best [Industry] tools for enterprise companies?”

- “Who are the top competitors to [Market Leader]?”

If your competitor appears in these lists and you don’t, they’re winning on AI search visibility. They have successfully associated their entity with the category itself.

Warning: Manual competitor analyses work for a one-off audit but fail at scale. AI models give different answers on different days based on random variance. You can’t manually check 50 keywords across 5 different models every single morning to spot trends. To spy on your competitors effectively, you need automation.

Automate Your AI Competitor Analysis with GetMint

Your competitors are currently winning these conversations because they’re the only ones playing the game. As long as this channel remains invisible to you, they have a monopoly on the AI answers.

GetMint helps you break that monopoly. It tracks the data and exposes your competitor’s playbook so you can dismantle it and reclaim your market share.

- The automated SWOT analysis tells you the exact value proposition the AI has accepted as truth, showing you the data gaps you need to fill to reclaim the narrative.

- The model breakdown highlights platform-specific weaknesses, giving you a clear beachhead to attack where your competitors are absent.

- The source explorer gives you a prioritized list of the exact domains driving your competitor’s success. Use them to target the specific PR hits that move the needle.

You can’t win a game you aren’t watching. Start your competitive audit with GetMint and stop letting your competitors own the conversation.

Frequently Asked Questions (FAQs)

What if the AI hallucinates features my competitor doesn’t have?

You can’t delete or edit the AI’s answer, but you can counter it. The most effective way is to publish a direct comparison page on your own site (e.g., “us vs. them”) with a clear feature table marked up in Schema. This ensures the AI ingests accurate, side‑by‑side data during its next retrieval, overriding false claims about competitor features.

Does AI favor big brands over startups?

Generally, yes. AI models rely on training data and citation volume. Big brands have more of both, making them the “safe” recommendation. For startups to win, you can’t just rely on brand awareness. You must focus on AI citations from high-authority niche sites (like G2 or specific industry blogs) to validate your entity to the model.

Can I see my competitor’s “AI Traffic”?

No. No tool can show you the exact traffic a competitor gets from ChatGPT. AI interactions are private. Instead, you track Generative Share of Voice. If your competitor appears in 50% of answers and you appear in 10%, you can infer that they’re capturing the majority of the invisible demand.

How often do AI models change their opinions on competitors?

It depends on the model. Perplexity and Google Gemini update in near real-time because they browse the live web. If your competitor launches a new feature today, these engines might reference it tomorrow. ChatGPT relies more on training data, so its “opinion” of a competitor is stickier and takes longer to shift.