B2B buyers now spend only 17% of their buying journey talking to sales reps. The rest is independent research.

That research creates the AI shadow pipeline. If you’re still forecasting revenue based on organic traffic or keyword rankings, you’re flying blind on a massive portion of your potential deals. You can’t close what you can’t measure.

To improve your forecasting model, shift your focus from clicks to the best sales metrics to track for AI visibility. These 6 metrics predict revenue in the AI era far more accurately.

How Do You Measure Sales from AI Search?

If your marketing dashboard looks confusing right now, you aren’t alone. You might see flat organic traffic, yet sales calls are still getting booked with highly educated leads.

The math doesn’t add up because the metrics that used to predict revenue have stopped telling the whole story.

- We used to obsess over rankings. But with Generative Engine Optimization, a static rank matters less than Share of Voice (SV). This measures market dominance: when a prospect asks an open-ended question, are you the primary answer the AI recommends?

- The same goes for clicks. In an AI conversation, the buyer often gets what they need without ever visiting your site. That doesn’t mean you lost them; it means you need to track AI mentions. These are AI word-of-mouth at scale; AI engines influence prospects even if they don’t click.

- Finally, where we used to count backlinks, we now look for AI citations. A backlink was a technical signal for a search engine. A citation is a trust signal for a human buyer. It’s a direct endorsement that drives the highest-intent leads in your funnel.

The 7 Best Sales Metrics to Track for AI Visibility

Since buyers spend most of their journey in digital channels, your sales team must track the metrics that reveal how visible they are in AI-driven search.

1. AI-Sourced Pipeline Value

For years, “organic search” was a single line item in your revenue report. But to understand your growth today, you need to isolate the revenue coming specifically from AI platforms.

This metric tracks the total dollar value of opportunities (your Pipeline ARR) that originated from or were heavily influenced by tools like ChatGPT and Perplexity.

This is important because standard analytics tools (like GA4) notoriously misclassify traffic from AI chatbots as “Direct” or “Referral.” This means your best AI-driven deals are likely hiding in your “Unknown” bucket, artificially inflating your “Direct” ****stats while underreporting your actual sales attribution for AI search.

→ Measuring the AI-sourced pipeline is the only way to prove that generative AI isn’t just a marketing experiment but a scalable revenue channel that rivals your paid spend.

Pro Tip: You can’t manually check every AI platform, but GetMint’s Visibility Score shows exactly where you’re cited. If you’re 64% visible on Perplexity and 0% on Claude, you know which referral tags to track. Stop looking for generic “AI traffic” and focus on the platforms where you actually show up.

2. AI Visibility Score

This is the simplest, most direct metric in your GEO tool’s dashboard. It measures pure presence.

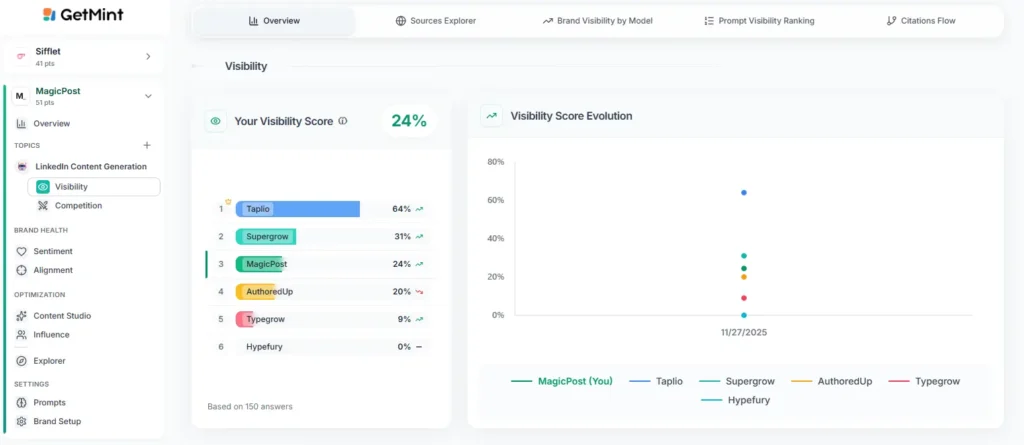

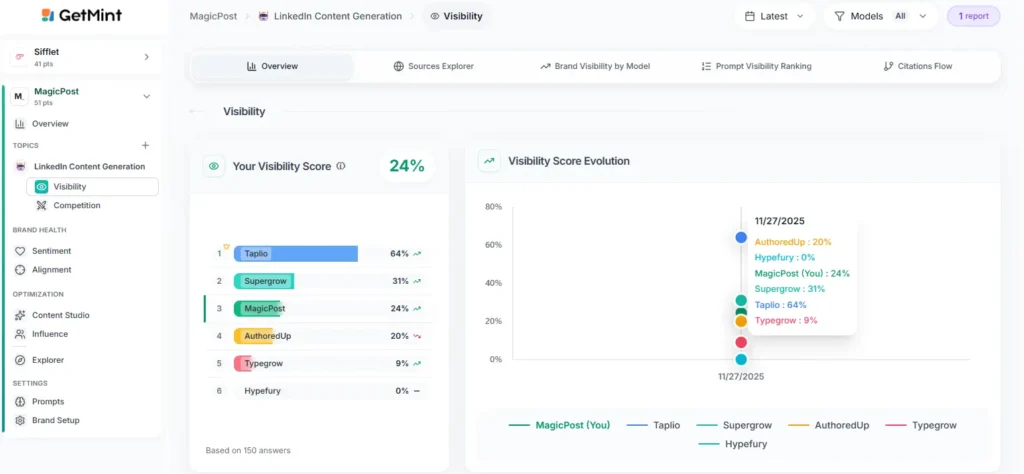

If there are 100 conversations happening about your category (e.g., “LinkedIn Content Generation”) and your brand is mentioned in 24 of them, your AI visibility score is 24%. It’s your at-bat rate.

- A 24% score means you’re in the room for 1 out of 4 potential deals.

- 76% missed means you’re completely invisible for the other 3 out of 4.

If your sales team is complaining about low lead volume, this is the first number to check. You can’t close a deal if the AI doesn’t even bring up your name.

Pro Tip: Don’t just watch your own score; watch who’s beating you. Taplio shows 64% visibility, while MagicPost has 24%, meaning 6 out of 10 prospects are already pitched on Taplio by the AI. Your sales team needs battle cards against Taplio now, because that’s who the AI is positioning as the market leader.

3. AI Sentiment Health

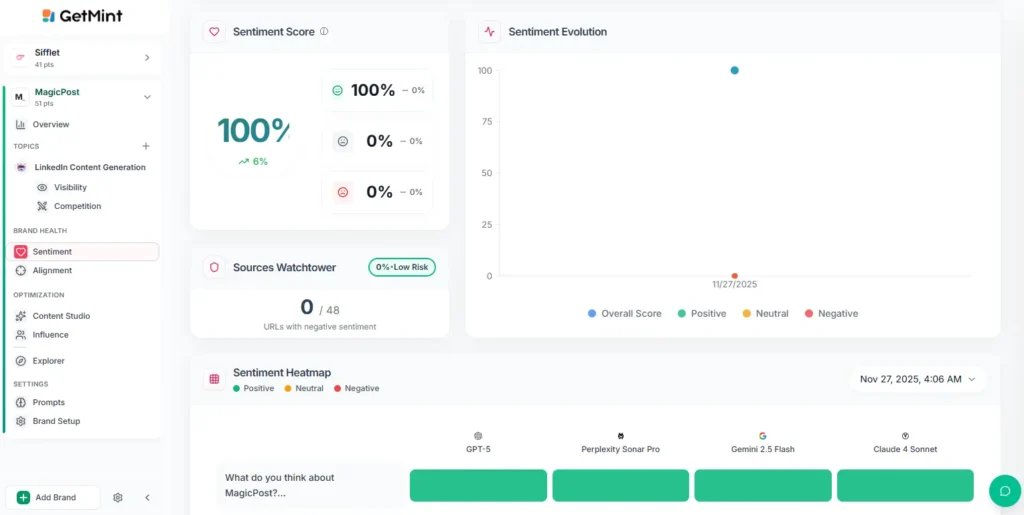

Visibility measures how often you’re mentioned. Sentiment measures how you’re mentioned. It grades the context of your AI mentions on a scale (positive, neutral, negative).

Sales care because this is objection pre-handling. If ChatGPT consistently describes your product as “powerful but expensive” or “great for enterprises but complex,” your sales reps are walking into objections they didn’t create.

- A positive sentiment accelerates the deal. The AI acted as a trusted referral.

- A negative/neutral sentiment stalls the deal. The prospect enters the call with doubt.

If your closed/lost reports are citing pricing or complexity, check your AI sentiment. The objection might be coming from the machine, not the prospect.

Pro Tip: Don’t wait for the quarterly report. Use GetMint to flag negative narratives immediately. If the AI starts hallucinating that you lack a specific feature (when you actually have it), that’s a revenue leak. Marketing needs to ship content to correct that record immediately so sales stop losing deals to false information.

4. Brand Search Lift

This measures the correlation between your AI visibility and your branded search volume on Google.

This explains the “mystery traffic” in your funnel. Here’s the common user behavior in 2026:

- Prospect asks ChatGPT, “Best tools for LinkedIn posts.”

- ChatGPT says, “MagicPost is great for automation.” (This is an unlinked mention).

- Prospect opens Google and types, “MagicPost pricing.”

If you’re only looking at SEO reports, you think that lead came from “organic search.” You’re wrong. That lead came from AI influence.

A rising brand search shows that your AI strategy is working. It means that people are learning about you off-site and coming to find you.

But a flat brand search could mean that, even if you’re visible in AI, the recommendation isn’t compelling enough to make them Google you.

Pro Tip: Look at the visibility score evolution in your dashboard. When your visibility spikes, check your Google Search Console a week later. Did searches for your brand name go up? If yes, you have proof that AI is driving real-world demand.

5. High-Intent Prompt Visibility

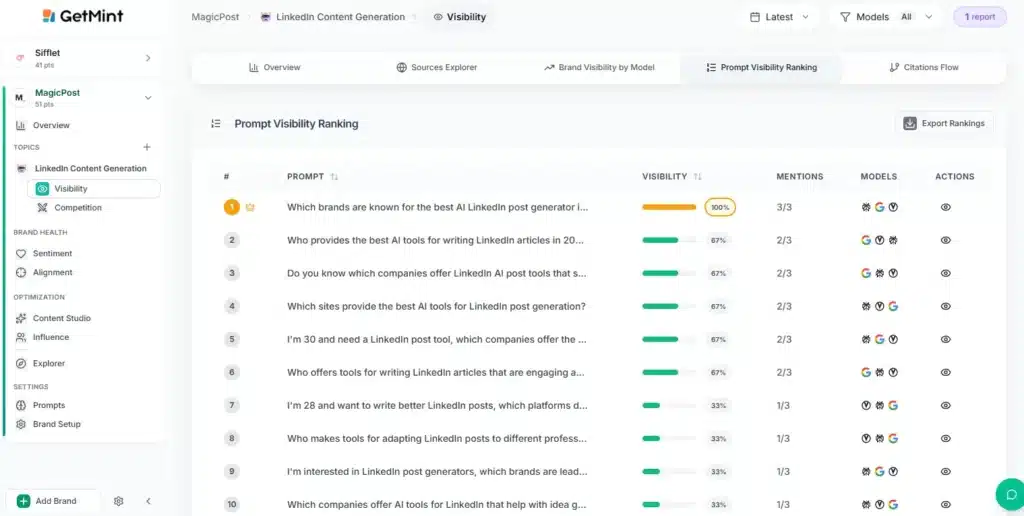

Not all visibility is created equal. This metric tracks your success rate on specific, bottom-of-funnel questions.

Look at this example.

Prompt #1 is “Which brands are known for the best AI LinkedIn post generator?” This isn’t a generic research query; it’s a buying question. The user is looking for a vendor list.

If you have 100% visibility on “What is an algorithm” (informational) but 0% visibility on “Best AI tools for 2026” (commercial), your pipeline will be full of students, not buyers.

- High visibility on buying prompts brings leads that are ready to demo.

- Low visibility on buying prompts means you’re educating the market while your competitor is closing the deal.

Pro Tip: Your sales team knows the specific questions prospects ask before they sign. Take the top 10 questions your reps get asked (e.g., “How do you compare to Competitor X?”) and plug them into GetMint’s prompt visibility ranking. Use the dashboard to see if the AI is answering those specific questions correctly. If you have 0% visibility on a direct competitor comparison question, that’s an immediate gap your sales team needs the marketing team to fix.

6. AI-Adjusted Customer Acquisition Cost (CAC)

This compares the cost of acquiring a customer via AI visibility vs. paid channels (LinkedIn, Google Ads, etc.). Your sales team cares about this metric because paid CAC is at an all-time high. B2B leads from LinkedIn can cost $200+ per click.

- With paid search, you rent the traffic. When you stop paying, the leads stop.

- With AI search, you own the visibility. Once the AI learns your brand, it continues to recommend you organically.

Tracking AI-adjusted CAC usually reveals that AI-sourced leads are 60% to 70% cheaper than paid leads over time. This allows sales leaders to reinvest that budget into closing deals rather than just buying clicks.

Pro Tip: Stop looking at just “cost per lead.” Look at cost per influence. Take your GEO software spend and content costs and divide it by your total monthly AI mentions. You’ll often find that a “high-quality mention” in Perplexity costs pennies compared to a click on LinkedIn. This proves that AI is your most efficient growth channel.

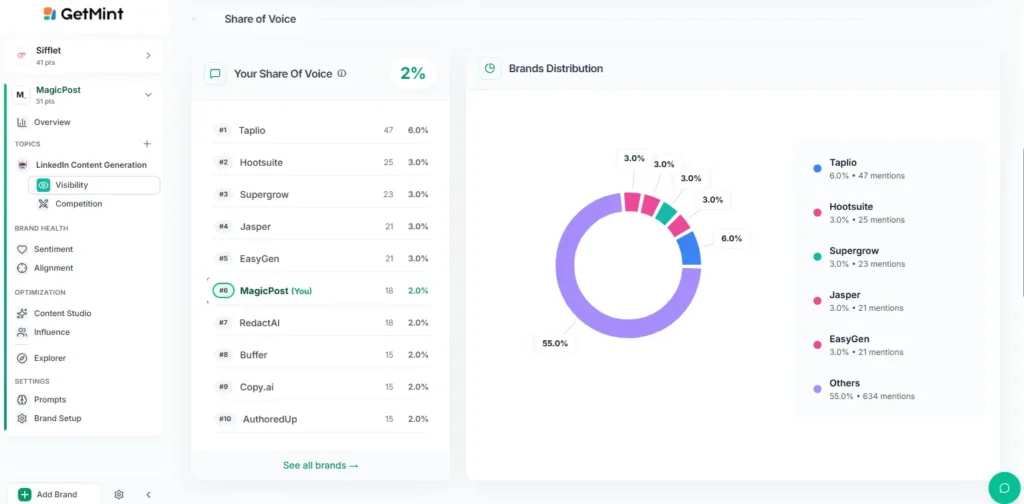

7. Generative Share of Voice

This is the macro view. Across all the millions of relevant conversations happening in AI about your industry, what percentage do you own?

In the dashboard above, the client has a 2% share of voice. That means for every 150 times a buyer asks about this industry, the brand appears only about 5 times and is absent in the other 145. This metric is effectively your market share.

- If your share of voice is rising, your future pipeline is growing.

- If your share of voice is flat (or 2%), you’re irrelevant. You’re fighting for scraps while the market leader is the default choice.

Pro Tip: Look at the brands’ distribution chart. It visualizes exactly how dominant your competitors are. If one competitor is eating 60% of the pie, your sales team needs to know that they’re the “underdog” in every deal. It changes the sales script from “education” to “displacement” (convincing them to switch).

Which Sales Metrics for AI Visibility Should You Ignore?

Not every number on a dashboard equals revenue. In the shift from traditional Search Engine Optimization (SEO) to AI search optimization, many marketing teams are still reporting on metrics that no longer correlate with sales outcomes.

If your team presents these numbers, ask them to dig deeper.

1. Raw Keyword Rankings (Without Intent)

Being #1 for a high-volume term like “What is software?” looks good on a chart, but it rarely drives the pipeline. Today, ranking for broad terms often triggers informational AI summaries that satisfy the user without a click.

→ Shift focus to how to optimize for AI search for commercial queries: the specific questions buyers ask when they’re ready to spend.

2. Total Impressions

An “Impression” in Google Search Console means a user scrolled past your link. In an AI chat, if you aren’t in the cited answer, you didn’t just get scrolled past. You were completely invisible.

→ Replace “Impressions” with AI visibility score. Being seen by 100 people in a trusted AI citation is worth 10,000 scrolling impressions on a SERP.

3. Bounce Rate

Traditionally, a high bounce rate was bad. But today, a user might click your citation, verify a single fact (pricing or integration, for example), and leave to sign the contract.

→ Focus on deal velocity. If they bounce but the deal closes 20% faster, the content did its job.

See Your AI Pipeline with GetMint

The sales metrics of 2020 aren’t broken. They just aren’t telling the whole story anymore because the buying journey migrated from a trackable Google Search to a private, invisible conversation inside an AI model.

If you’re a revenue leader, you have two choices:

- Ignore the new metrics and continue on “direct traffic” to explain your pipeline, effectively flying blind on 30% of your buyer’s journey.

- Treat the AI shadow pipeline as a legitimate revenue channel. Track who is winning the market share, monitor the sentiment, and attribute the revenue.

The AI era has moved the sales’ attribution signal, and you just need the right tool to hear it. GetMint makes generative visibility actionable, so you can tie it to real revenue impact.

Audit your AI visibility with GetMint today.

Frequently Asked Questions (FAQs)

Is AI visibility data actually accurate?

It’s accurate, but it’s probabilistic. Unlike Google Search Console which gives you exact server data, AI visibility tools use clickstream data and estimated modeling to calculate Share of Voice. It’s excellent for spotting trends and sudden drops in market share.

Isn’t “visibility” just a marketing vanity metric?

It used to be. But in the AI era, visibility is binary. In a Google Search, being #4 still got you clicks. In an AI answer, if you aren’t in the top citation, you usually aren’t mentioned at all.

Therefore, AI visibility is now a direct proxy for market share. If your visibility drops, your future pipeline will drop.

Can’t I just track this with Semrush or Ahrefs?

Those tools are excellent for SEO (Google), but they have blind spots with GEO (AI). Most traditional tools track “rankings,” whereas GetMint tracks mentions and citations across multiple LLMs (like Perplexity, Claude, and Gemini) that traditional crawlers often miss.

How quickly does AI visibility impact sales?

AI mentions are a leading indicator. We typically see a 4–6 week lag between a spike in mention velocity and a spike in pipeline creation. If you wait to see the revenue dip before you fix your AI visibility, you’re already two months behind.

What is the difference between a “mention” and a “citation”?

A citation includes a direct link to your website (driving referral traffic). A mention is when the AI discusses your brand without a link (driving brand awareness). Sales leaders often ignore unlinked mentions, but they’re critical: they drive the “brand search lift” that eventually results in a high-intent demo request.